Last Updated on September 7, 2025 by Full-Time Job From Home

Pogo has been grabbing plenty of buzz lately among people looking to squeeze more value out of their everyday spending. With the growing sea of money-saving apps, figuring out if Pogo is truly worth it—and what it actually does—can be confusing.

After trying it out myself, I spent some solid time digging into its features, checking out the security side, and comparing the rewards. Below, you’ll find a clear review of what to expect if you decide to download it.

Summary: Pogo is legitimate but offers only very modest earnings—you link your bank or card via secure Plaid integration, and in exchange for your purchase and location data, you earn small amounts of cash redeemable through PayPal, Venmo, gift cards, or even charity donations. Users report slow customer support and minor payouts rather than scams, and while the setup and data-sharing may feel a bit intrusive, the app essentially delivers what it promises: low-effort rewards for everyday spending

In this Pogo Review, I’ll cover:

- Pogo App Review

- What is Pogo and How Does it Work

- Ways to Earn and What to Expect

- Is Pogo Legitimate

- Pogo Safety

- Data/Privacy Concerns

- Alternatives

- How to Earn More

- Pogo FAQs

- Is Pogo A Scam

Pogo App Review

Name: Pogo App

Type: Paid To Shop, Paid To Share Data

Verdict: Legitimate, Small Income

What Is Pogo and How Does it Work?

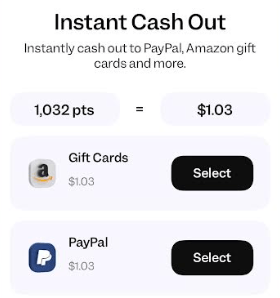

Pogo is an app meant to help you earn small cash rewards by sharing your purchase and location data. The idea is easy to get: link your bank or credit card accounts, let the app access your digital receipts, and then Pogo gathers and uses your transaction data for market research. In return, you pocket points that you can cash out for gift cards, PayPal, Venmo, or even charity donations.

When signing up, Pogo asks you to connect a financial account—usually the main card or bank account you use for regular shopping. Once that’s set, Pogo analyzes your transactions automatically in the background; there’s no need to track or scan receipts one by one. The more you spend, and the more data Pogo can see, the more points you rake in.

Every so often, you might unlock bonus opportunities, like linking extra accounts, taking a quick survey, or accepting special offers at certain stores that Pogo partners with.

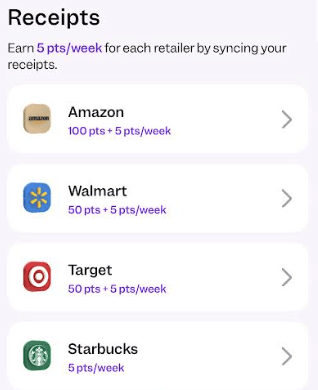

One standout feature is Pogo’s automatic receipt scanning. After you link your account, every qualifying purchase earns points automatically, saving you the hassle of logging each receipt.

There’s also a savings side to Pogo, where you can make a few more bucks by switching utility providers, claiming exclusive shopping deals, or getting cashback for online purchases through Pogo’s links. This flexibility adds an edge, letting users grab rewards without jumping through hoops.

Ways to Earn and What You Can Expect

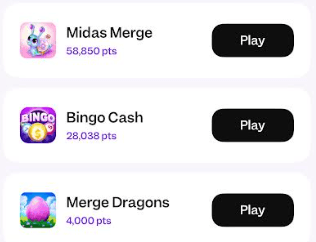

Pogo’s earning setup is pretty simple—points for purchases, an occasional bonus for extra actions, and cashback for grabbing special offers. While it isn’t a replacement for a steady paycheck, it can bring in small recurring paydays if you keep engaging with the app.

- Points for Purchases: Any transaction Pogo can see from your linked accounts earns a few points. Usually, this means a couple of cents per transaction, but if you’re a frequent card user, those pennies grow over weeks.

- Deal Offers: Some brands and stores set up limited-time offers in Pogo, so you can grab bonus points just for your normal shopping—provided you click the offer first and shop through Pogo.

- Surveys and Extra Actions: Pogo will sometimes send over brief surveys or ask for a little extra info about a purchase. Doing these gets you some extra points and may help unlock fresher offers next time around.

- Referral Bonus: Bring a friend on board; if they join and link their first account, you earn a small one-time bonus in your points balance.

For those who enjoy steady, low-key winnings, Pogo works best as a background app. Remember, it’s not about big quick wins—it’s more like a slow drip of a few bucks every month if you use it consistently.

Most users report cashouts that range from five to twenty bucks per month, depending on how active you are and how many bonus deals you snag.

Is Pogo Legitimate?

This is a main sticking point for anyone before linking up their personal accounts with apps like Pogo. I checked reviews and combed through Pogo’s privacy policy to get a better sense of the real deal.

Pogo is backed by investors, runs on both the App Store and Google Play, and gets some trust points for that. Scores of users report easy payouts through PayPal and Venmo. To link accounts, Pogo uses bank-grade encryption (through Plaid), which means your real banking login isn’t seen or stored by Pogo itself.

What do users gripe about? Slow customer support and small payouts, rather than fraud or scams. On Trustpilot and Reddit, reviews usually mark Pogo as reliable for its promises—micro-payouts in return for your personal data. As always, it’s smart to do your own digging and make sure you’re okay with the app’s approach to privacy.

Account Linking and Safety: Should You Link Your Bank Account?

Pogo needs just-read access to your bank or card transaction details. This is standard for fintech and cashback apps, though it understandably can make some people nervous—it did for me at first!

- Data Handling: With Plaid stepping in, Pogo never sees your actual login details. Plaid, which also powers Robinhood, Venmo, and Acorns, scrambles (encrypts) your info and sends only what’s truly needed—transaction data—back to Pogo for reward calculations.

- Privacy Policy: According to their privacy statement, Pogo is much more clear than some about collecting and using your transaction and location data mainly for market analysis, meaning brands use it for research and targeted ads.

- Risks: Any time you share financial data, there’s some built-in risk, but Plaid is trusted and helps shrink those worries. If you ever have second thoughts, you can disconnect accounts or delete your profile right from the app’s settings.

If you aren’t good with sharing personal data for small returns, you might want to sit this one out. For others who are okay with today’s fintech approaches, Pogo’s setup is similar to other money-saving or rewards apps. Just remember to use a strong password and keep your app updated for best security.

What Are You Trading and What Are the Potential Rewards?

Apps like Pogo run on the value of your personal information—no way to sugarcoat it. They gather data on your shopping habits, how much you’re spending, and often your location.

- Data for Dollars: By using Pogo, you’re giving permission for them to analyze your entire shopping life. That info ends up supporting research and ad strategies.

- How Much Money: Typical returns are small—a few dollars a month with steady use. Good for treating yourself to a coffee, but not a substitute for a real side hustle.

Are you cautious with your privacy? Make sure you know what you’re giving up in exchange for points and rewards. If you’re already using similar apps like Dosh or Rakuten, Pogo may fit seamlessly; just always check that the trade-off feels right for you.

How Does Pogo Stack Up Against Other Earning Apps?

Pogo’s standout perk is that it takes a “set it and forget it” approach. Other options, like Ibotta, often make you upload receipts, which can be a pain. Pogo does nearly everything automatically, tracking your spending with minimal fuss.

The flip side: payouts are smaller and slower. Survey apps can pay more, but you need to actively work at them. Sites like Rakuten sometimes dish out larger rewards, but only when you shop with certain merchants. Pogo doesn’t care where or when you spend, so it’s more passive but less lucrative.

Pogo is best for folks who want to earn in the background—no extra work, no new habits. If you’re after big payouts or have serious privacy concerns, you might want to consider something else.

Tips to Get the Most Out of Pogo (and Stay Secure)

- Connect More Accounts: More linked accounts mean more tracked spending, which means more points over time.

- Jump on Bonus Offers: Look out for special deals or offers in the app and act quickly before they’re gone.

- Manage Your Data Settings: Double-check what permissions you’ve given, and regularly adjust if your comfort level changes.

- Redeem Promptly: Once you hit the withdrawal minimum, cash out so you don’t risk losing rewards to account hiccups.

The best way to use Pogo is to let it run in the background—don’t buy more just for the points, and watch as small cash rewards build up naturally.

Pogo App Frequently Asked Questions

Will Pogo sell my information? Pogo uses your information in an anonymized format and shares it with partners for analytics and market research. They don’t sell individual user details with your name, but your data still helps shape marketing tactics.

Can I use Pogo without linking my bank account? Nearly all of Pogo’s rewards require account linking, since transaction tracking is essential. Some quick bonus offers may crop up, but for steady earnings, linking is a must.

How quickly can you cash out? After you hit about $3 (with some minimums varying a little), you’re eligible to cash out to PayPal, Venmo, or as gift cards. Reports suggest payouts are usually processed promptly once you cross that threshold.

Will Pogo sell my information? Pogo uses your information in an anonymized format and shares it with partners for analytics and market research. They don’t sell individual user details with your name, but your data still helps shape marketing tactics.

Is the Pogo App a Scam?

Pogo is a straightforward way to make your day-to-day data work for you, earning a little extra cash each month. While it won’t replace a full side gig, it’s a decent pick for anyone already exploring cashback or passive earning apps.

Always remember you’re swapping a bit of privacy for those small rewards. Keep tabs on your data-sharing, make sure you’re comfortable with the setup, and enjoy a few bucks of bonus money from your usual shopping routines.

If you think sharing your data for a few extra bucks each month, visit JoinPogo.com to sign up.

Sharing your data with an app like Pogo by connecting your bank accounts is not for everyone. Check out these other ways I recommend making money online:

Work From Home Jobs Hiring Now

Build Your Own Online Business

Do you plan on using the Pogo App to earn a few bucks each month for sharing your data? Feel like Pogo is a scam? We’d love to hear your thoughts in the comments below.